The year that was: 5 trends that shaped 2023 for financial institutions

Posted by

Sandstone Technology on Dec 13, 2023 11:47:42 PM

Topics: mobile and digital banking, AI and Machine Learning, Digital Banking

The year that was: 5 trends that shaped 2023 for financial institutions

The 2020s have shaken up the world as we know it, and we’re only four years in.

The pandemic, economic volatility, social and behavioural change, followed by corresponding waves of tech advances - all have had tremendous impacts on financial institutions. With the final weeks of 2023 fast approaching, we look back at the trends that have been re-shaping the finance sector and continue to drive its evolution.

.jpg?width=365&height=206&name=shutterstock_1954078291%20(1).jpg)

Inflation, rising interest rates and the cost-of-living crisis have affected consumers around the globe. While some with savings have taken advantage of higher interest rates, many have had to use their savings to keep afloat. In many markets, people are experiencing loss of purchasing power; meanwhile the cost to borrow money increases.

That said, economic upheavals have had some positive effects, sparking innovation in banking products and functionalities, whether it’s apps prompting next best actions or goal-setting options combined with “nudges”. Financial institutions (FIs) are offering payment holidays, and in some cases, reduced interest rates on credit cards, or auto-debt repayment features, to help people through difficult patches.

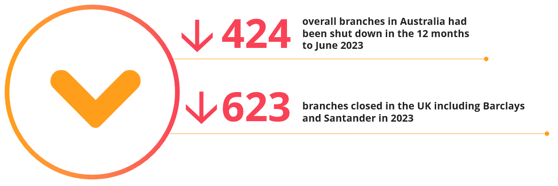

Escalating branch closure rates in many regions are making digital banking and apps the only convenient option for many. The UK has seen 623 branches shut up shop in 2023, including Barclays and Santander. In the US, thousands have closed every year since 2008, with 3000 closures in 2022 and only 1000 new branches opened. The Australian Prudential Regulation Authority found that in the 12 months to June 2023, 424 branches — 11 per cent of Australia's overall branches — had been shut down.

The most common reason given for ditching bricks-and-mortar locations is the changing preferences of customers, with budgets diverted into improving digital banking. While closures enable cost-cutting and efficiencies, having fewer branches does make it more difficult to maintain close relationships with some customers. As we outlined in a separate blog, physical branches offer a strong face-to-face channel for interactions. They enable an FI to go beyond the transactional relationship, to attract and retain customers, something that building societies do so well with their members.

One more important factor in the mix, is the growth of Generation Z as a banking segment, outlined further in this article. No wonder mobile and digital banking channels are dominating, with this confluence of events - imagine when generative AI comes into full effect! We expand on that further below.

In our daily dealings with FIs, Sandstone is hearing about the flow-on effect of all these factors. For us, 2023 can be characterised by five main themes, re-capped here.

They’re adults, or soon-to-be adults, and they’re not to be ignored! Earlier this year, we published our article, Rollin’ with Gen Zs and Alphas: what financial institutions need to take on board, exploring the features and services these younger generations value from their FIs. As Sandstone's UK Product Manager, James Sheldon explains, this population expects a different experience from what has traditionally been delivered by banks.

“An expectation has been set by the challenger banks and fintechs, that a digital solution should help elevate a customer’s financial position, by offering the tools and services that facilitate their progress in the financial world,” Sheldon says.

App-native origination, using biometrics and push notifications, delivers the app-first journey they demand, focused on user experience. Features such as savings forecasting enable customers to visualise the pathway to their financial goals. Customisable, contactless limit controls can help control their spending; and live chat capability allows the FI to adapt to a more flexible and customer preference driven communication model.

Gen Zs are demanding frictionless, omnichannel digital experiences and personalised – even hyper-personalised – products, services and experiences. But that relies on good data and analytics which continue to be a challenge for many FIs. Legacy platforms can also make changes difficult for banks, as Sandstone Technology’s Sales Director UK Colin Rankin points out.

“Unlike the newer startups, traditional banks generally have online and digital services that are ‘one-size-fits-all’, making it more difficult to segment markets and target specific customer groups. FIs need to provide more targeted digital and/or mobile services that give the consumer some choice in the service that they get,” Rankin says.

Bearing in mind that Gen Zs have access to a myriad of data points that shape and influence their decision making; and as easy as it is in 2023 to find a new FI online, it’s equally easy to leave your FI. According to Nam Vuong, Sandstone’s Australian Head of Business Development, FIs should focus on partnering with a vendor that is experienced and can assist an FI go to market rapidly, rather than the FI trying to build the capability themselves.

In our article from early 2023, Cybersecurity in banking: the top 5 threats for 2023, we outlined the trends most likely to affect institutions and consumers in 2023.

.jpeg?width=190&height=164&name=shutterstock_1932256898%20(1).jpeg)

Download the cybersecurity article

Since then, cybercriminals have been honing in on the most vulnerable regions and groups and refining their approaches. Strangely, Gen Z has proven to be one of those vulnerable groups, despite being the first truly digital natives, something we described in our blog, Why so many Gen Zs end up being cybercrime victims. Governments globally are launching initiatives to educate citizens and protect them – young and old – from the threat of cyber scams; banks play a crucial role here as well.

As the digitisation of banking increases at a rate of knots, it unfortunately opens up more opportunities for bad actors to exploit, and cybercrime increases at the same rate. According to an EY survey, 72% of chief risk officers say cybersecurity risk is top of their list of priorities in 2023, beating credit risk - “despite the billions invested to safeguard core systems and vital data assets”.

In his wrap-up of 2023, Sandstone’s Head of Security Julio Kim describes 2023 as: “another year marked by security incidents and data breaches, often involving service providers responsible for managing critical operations on behalf of the breached companies.”

One result of this increasing risk trend is that regulatory requirements have also ramped up, targeting assurance not only from FIs but also from their supply chain.

“It is imperative to select a partner who is not only specialised in their product offerings but also takes security and reliability seriously, adopting a holistic approach to keep the business running in a secure and compliant way,” Kim says. Sandstone partners benefit from solutions with built-in security features which are reviewed constantly to address new cyber threats as they evolve.

The mobile app has transformed the user experience, and self-service banking is now a central tenet of good customer experience. People want to transact on their own terms and get it done quickly. “Everyday banking should be streamlined and fast, and available anywhere, anytime,” Nam Vuong explains.

As we discussed in our blog on self-service banking, the move to digital, in particular, mobile, is being driven by the closure of branches, the uptake of digital generally during the pandemic and improvements in app and web experiences. As mobile uptake skyrockets, there’s also an increased use of e-wallets, and digital or mobile wallets for payments. As a result, banks are increasingly focused on developing mobile-first strategies and offering services optimised for mobile users.

“Sandstone digital banking solutions help FIs meet consumer expectation with a range of features including Digital Wallet, FX payments and NPP, to name but a few,” Vuong says. However, some FIs with dated, inflexible infrastructure will still struggle to provide innovative digital banking. Unfortunately, if they don’t provide self-serve options, they will miss important banking benchmarks and lose out to competitors.

“Sandstone digital banking solutions help FIs meet consumer expectation with a range of features including Digital Wallet, FX payments and NPP, to name but a few,” Vuong says. However, some FIs with dated, inflexible infrastructure will still struggle to provide innovative digital banking. Unfortunately, if they don’t provide self-serve options, they will miss important banking benchmarks and lose out to competitors.

In two additional blogs, we explored the role of seamless digital channels in and preventing churn. Consumers want hassle-free, engaging and rewarding experiences on the path to realising their financial goals, and a holistic, digital view of all their accounts and services. As Colin Rankin explains, push notifications, easy access to open banking services, and a single portal for all bank services are all becoming de rigueur.

“Until the last few years, it was simply expected that everyone received the same digital experience; the customer would need to guess which path would be right for them,” James Sheldon says. Now, with the explosion of data and insights, an experience can be tailored to a customer’s needs, giving a greater chance for the best customer outcome.

Open Banking has also enabled a leap forward in customer experience. “With the Sandstone product set, making a payment via app-2-app in just a few clicks is a part of everyday banking. So is gaining access to industry-leading financial products by providing consent to securely share account data with third parties.” Sheldon points out.

What customers don’t want is to have to leave their app or website and talk to a staff member, as part of onboarding. It’s not okay to only offer the bare minimum of functionality on mobiles and online - not when the customer can apply for a new account or loan online with a competitor quickly, online.

With citizens of the globe now travelling freely and often, and working from remote locations, international payments remain a hot topic. In our earlier article, International Payments making big strides, creating big opportunities and in our International Payments Whitepaper, we addressed barriers to cross-border payments, the explosion of new technology, the growth of real-time systems, payment rails and improved interoperability across different payment systems.

A report commissioned by Citi and released in September 2023 identifies the race between new entrants and existing FI players for cross-border payment revenues, a pie already estimated at “over $200 billion and expanding at a high single-digit annual growth rate”. Flows are expected to reach $250 trillion by 2027. The report also highlights the need for FIs to meet consumer expectations for a streamlined, transparent, 24x7 real-time experience. Whether retail, corporate or institutional, customers expect the same speed and traceability as they’re accustomed to with domestic payments.

83% of banks surveyed by Citi recognise application programming interfaces (APIs) as the key technology to improve client experience. As the report says, “Payments are moving away from traditional instruction methods, which are tied to batch and files, and moving toward application programming interface (API) connectivity.”

AI has certainly been a key conference topic throughout the year. We attended various events in the UK and Australia in 2023, starting with the UK Banking Transformation Summit, June 2023.

Meanwhile, at the UK’s CX in Financial Services Conference, 57% of the audience members polled said they were planning to use AI. Of course, AI cannot do its job without data quality and data governance in place.

As Nam Vuong puts it, “AI & Machine learning technology will allow FIs to compute vast amounts of often complex data. But rubbish data in = rubbish data out, and machine learning still requires a considerable amount of quality manual teaching to ensure results aren’t subjective.”

At Australia’s Future of Financial Services conference, “There was barely a session that did not touch on AI in some way”. There were sessions exploring use cases for next best offers/conversations, push/pull notifications, OCR technology, and in the not-too-distant future, the ability to drive conversational banking using hyper-personalised experiences in real time. With no human interaction!

For FIs that successfully manage the risks and recognise its full, transformative power, Gen AI has the potential to “fundamentally positively disrupt how front, middle, and back office functions behave”, according to a recent report published by Analyst Research firm, PAC, and quoted by PwC. With its ability to predict market trends, Gen AI can prevent fraud, enhance banking operations and help leaders make informed decisions; even support regulatory compliance and security.

While the conversation around AI/Gen AI may be overwhelming for some FIs, Sandstone’s Chief Customer Officer, Jennifer Harris, believes it’s about picking one use case that can have a direct impact on the FI and their customers, and running with it - whether it’s for driving efficiency or enhancing the customer experience, or both.

“The key is to understand your business pain points, and the pain points of the audience you are catering to, and ask: what could be automated at that level? For instance, what would happen to operations if you were to eradicate or even lessen them by a certain percentage? Weighing up the art of the possible in real terms will help the business focus on those critical use cases.” Harris added.

It may also be that financial institutions need to first overhaul their core banking services, making them more open and accessible, before they can leverage AI and ML. But the potential is huge. As Nam Vuong says, “AI will advance and leapfrog our capabilities like the world wide web did when it first launched.”

2023 has been another in a series of tumultuous years. The challenge for FIs is to adopt transformative technologies faster to meet market demands and drive competitive advantage, whether AI, payment APIs, cybersecurity controls or sophisticated digital functionality.

FIs must work with technology partners that understand their priorities and obstacles, and help them overcome internal and industry-wide challenges. Talk to Sandstone Technology about how you can start scoring small wins today, that add up to huge efficiency and revenue gains in the longer term.

Topics: mobile and digital banking, AI and Machine Learning, Digital Banking

It is impossible to discuss the role of AI in financial services without highlighting that 2020 was hugely disrupted by COVID-19 and the ripple effect is expected to last for years...

.png?width=1280&height=807&name=shutterstock_440065846%20(1).png)

As big data becomes a fact of life for both consumers and banks, it introduces new avenues for creating revenue streams...

Fintech digital transformation can be made much simpler if partners are willing to drive value in the direction of their customers. With more innovation taking place in the industry, the ability to meet the customers' need is what sets a company apart from the rest...