LendFast

LendFast

As the financial services market gets more competitive and digitalisation raises customer expectations, the old ways aren’t cutting it.

Origination platforms of today need to meet consumer pain points. They need to give better customer experiences, efficiencies across the value chain and complete, end-to-end solutions.

LendFast lets you control the process from the original data capture through to settlement of the loan. It’s a trusted solution that works with credit card applications and consumer loans, mortgages and mortgage top-ups, using automation and AI to streamline processes like document verification, policy checking and fraud detection.

Not only that, LendFast’s easy implementation will get you to market faster.

*based on end-customer loan requirements. Result from Tier 2 customer in-market deployment.

*based on in-market customer feedback

Customers love the shorter waiting times for assessments, and the real-time alerts when data or documentation is missing. For your loan processing staff, the interface is simple and intuitive providing them with a positive UX - alleviating frustration and meeting their needs. LendFast matches rising consumer expectations for smart digital solutions while providing efficiencies in the back end for staff.

LendFast’s AI-driven system detects potential fraud and sends alerts. Customisable rules automatically implement policy checks and ensure applications adhere to responsible lending standards. That means lower training costs for staff across the value chain.

The user experience is seamless and easy for lending staff and customers, with fewer bottlenecks, faster decisions and low touch on data and documents once uploaded. Lower cost per application and higher conversion rates amount to higher revenues.

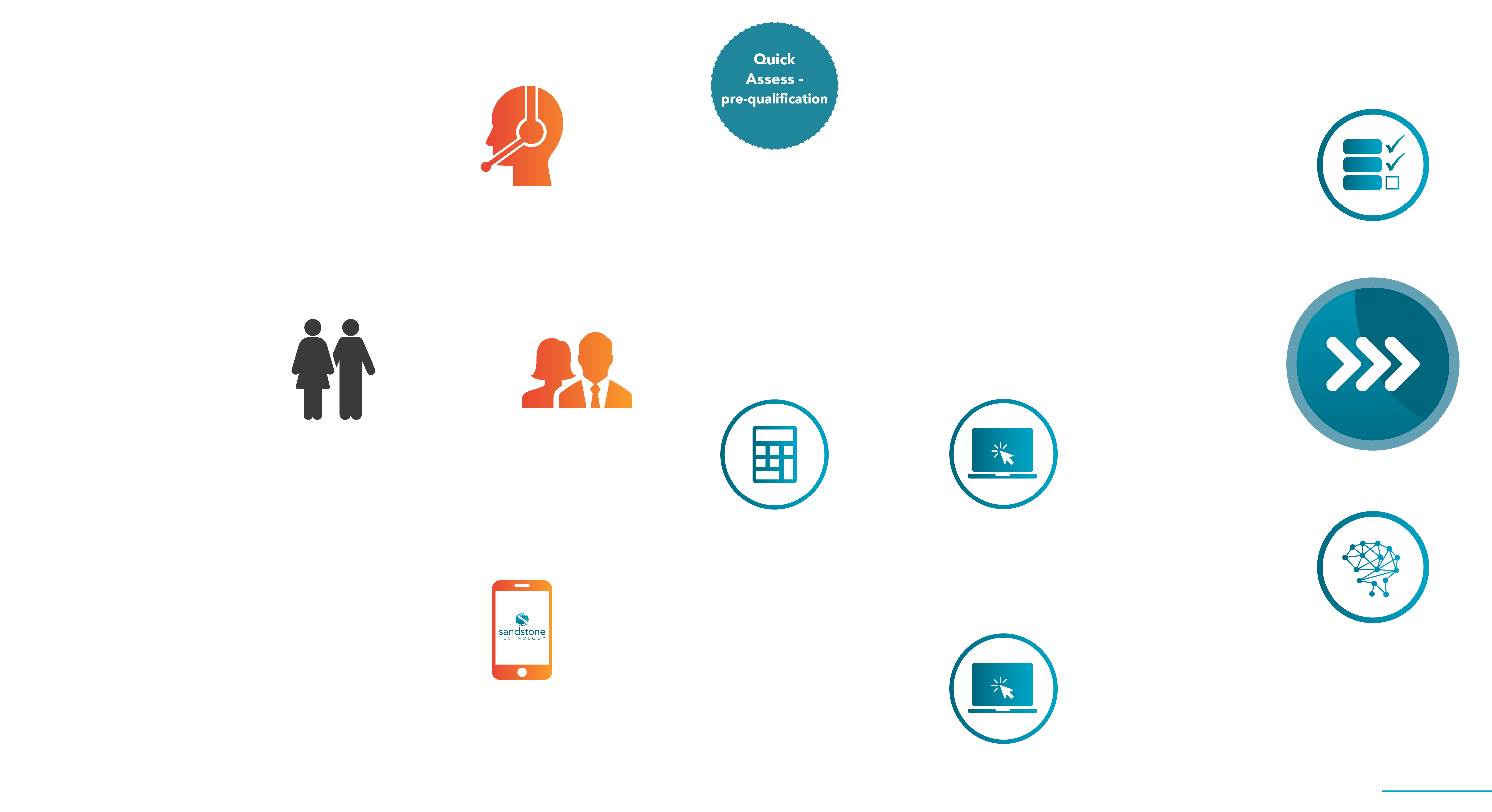

LendFast manages the entire process, from application capture and quick assessment, to approvals, contracts and settlement. The platform incorporates our automated digital intelligent verification assistant (DiVA) and end-consumer portal (Tracker), improving your data quality and vastly speeding up verification while providing a level of visibility and transparency.

Easily integrated with minimal impact to BAU, LendFast is scalable and configurable according to your business rules, loan type, product rules, SLAs and data. Meanwhile fast deployment of new features as they’re released helps you keep pace with market demands.