6 ways to automate your savings products

Posted by

Sandstone Technology on Oct 20, 2022 12:31:54 AM

Topics: Digital Banking

6 ways to automate your savings products

It’s a 24/7 job, balancing your incoming deposits with your outgoing lending. In turbulent times, it’s more important than ever for financial institutions (FIs) to automate their tranche management processes to reduce risk and take pressure off employees.

With real-time monitoring, alerts and fail safes, Sandstone Technology’s tranche management feature is already taking worry and risk out of managing the lifecycle of deposit products. We spoke with Sandstone’s Product Manager, James Sheldon and Sales Director, Graeme Murray-Shirreff, about the six key benefits of automated tranche management functionality.

Treasury, product management and financial teams have their work cut out for them, according to Graeme Murray-Shirreff.

"If they don’t pull enough revenue in, they don’t have enough to lend. If they receive too much, that money sits idly in their bank account, costing the bank money as they pass on the interest to deposit customers” Murray-Shirreff says.

This perpetual inflow of retail and business deposits has traditionally been managed through time-consuming, physical processes, carried out by two different areas within the business. First, the financial controllers looking at high-level figures, balancing and restricting the money going in and out. And second, the operations staff doing the actual monitoring, the reporting, and putting systems in place to get those high-level numbers to the financial controller. Usually, these teams are extracting data from core systems, often using Excel files with complex formulas, sharing that data around and storing it (a risk in itself).

Contrast that with automated tranche management, which manages the flow of retail and business deposits easily and quickly, whether ISAs, term deposits/bonds, regular savers, instant access – essentially any savings products in market.

With in-built notifications, there’s no need to log into the system to check and monitor products 24/7. And with real-time information, operations staff don’t need to pull reports from core systems, and try to match them with current product performance.

Using the tranche management functionality built into Sandstone Technology’s BankFast Apply digital origination solution, organisations can easily add pledged, funded and/or application volume limits when setting up a deposit product. Once live the tranche management feature will then continually monitor applications in real time.

When a savings product reaches an alert level or a limit, notifications are sent to staff via SMS or email. At that point, the bank might want to consider whether the product is selling too fast, or whether they should increase the limit, according to their business strategy for the product.

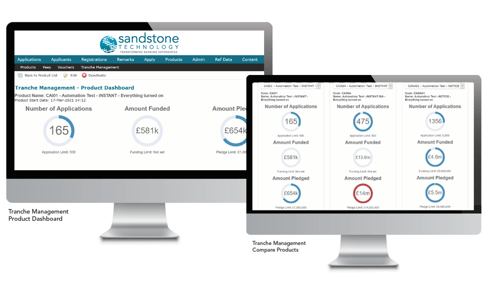

Staff using Sandstone’s tranche management system can access visual dashboards for reporting, analytics and audits. They can report based on three different metrics: the amount customers say they will fund (pledged amount); the volume of successful applications (based on how many the bank’s staff or processing capabilities can manage); and the actual funded amount.

Having real time monitoring and visibility in reporting across those three metrics allows for decisions to be made quickly, e.g., whether to close the product, or as above, automatically deactivate the product.

“What you’re eliminating is that back-and-forth on funded amounts when the expectation for funds is not being met,” Murray-Shirreff says. If there’s not enough money coming in, the savings team has to consider whether to create another product and bring it to market. And if too much is coming in, the savings product owner and lending team need to discuss whether they can lend the extra funds out. If not, should they turn that product off? These discussions take time.

With automated tranche management, the financial institution has those conversations ahead of time. They decide up front what they’ll do in those scenarios. It also eliminates that need for change control for the team that has to go in and modify the product or take it off the market: there’s already a defined process agreed within the business.

Today, many FIs are calculating funded amounts as a back-end assessment, i.e., once the application is successful and it reaches the core system, you see what actual funds are in the deposit and measure how they compare against what needs to be lent out.

Unfortunately, as Sandstone Product Manager James Sheldon points out, if the customer has had seven to 14 days to fund that account, there can be a lag: the data can be a week or two old, and there’s a risk you won’t get the funds you need.

"A tranche management system like the option in our BankFast Apply digital origination solution is very much at the front end of the digital banking channel, at the banking application stage." says Sheldon.

The Sandstone online portal gives a bank or building society an idea of what’s likely to end up in the back end, either by:

All banks and building societies need to put processes in place to manage their liquidity risk ratio and ensure regulatory deposit limits do not exceed their intended value. They also need to be confident they can cater for a potential run on the bank without holding unnecessary funds.

An automated tranche management system vastly reduces the risks that attach to guessing product tranches and takes pressure off product management and treasury teams. With fewer manual processes and predictions involved, it also reduces human error.

As Sheldon explains, in Sandstone’s tranche management feature set, there’s a capability to compare products using visual aids, showing volumes coming in versus limits set.

Clients can compare up to three products - perhaps two inflight products to contrast with a historic product. In that way clients can look at how their inflight product is performing, in real time, against the last product they launched. They can predict trends in behaviour for future product launches and make more informed decisions about how to set up future issues.

Without an automated tranche management system, banks and building societies may experience lost time and resource, risk exceeding funding, having errors in reporting and even regulation breaches. There is also potentially a delayed time to be notified and act.

In our three decades of operation, Sandstone Technology has committed to finding ways of automating and making those processes more efficient in our digital banking technology, with less risk. Our solutions are already servicing some of the UK’s established financial organisations including Shawbrook Bank and Arbuthnot Latham Banking.

Tranche management solutions are part of the BankFast Apply digital origination solution that includes straight through processing, real time account opening, Strong Customer Authentication and regulatory compliance. It also offers multiple delivery models including cloud, optimised journeys covering multiple savings products, retail and commercial deposit origination and servicing – and more.

We’re also an integration specialist so organisations don’t need to change their core banking systems; our digital banking solutions simply sit in front of their existing systems.

Article published October, 2022

Topics: Digital Banking

It is impossible to discuss the role of AI in financial services without highlighting that 2020 was hugely disrupted by COVID-19 and the ripple effect is expected to last for years...

.png?width=1280&height=807&name=shutterstock_440065846%20(1).png)

As big data becomes a fact of life for both consumers and banks, it introduces new avenues for creating revenue streams...

Fintech digital transformation can be made much simpler if partners are willing to drive value in the direction of their customers. With more innovation taking place in the industry, the ability to meet the customers' need is what sets a company apart from the rest...