![]() BankFast /BXP

BankFast /BXP

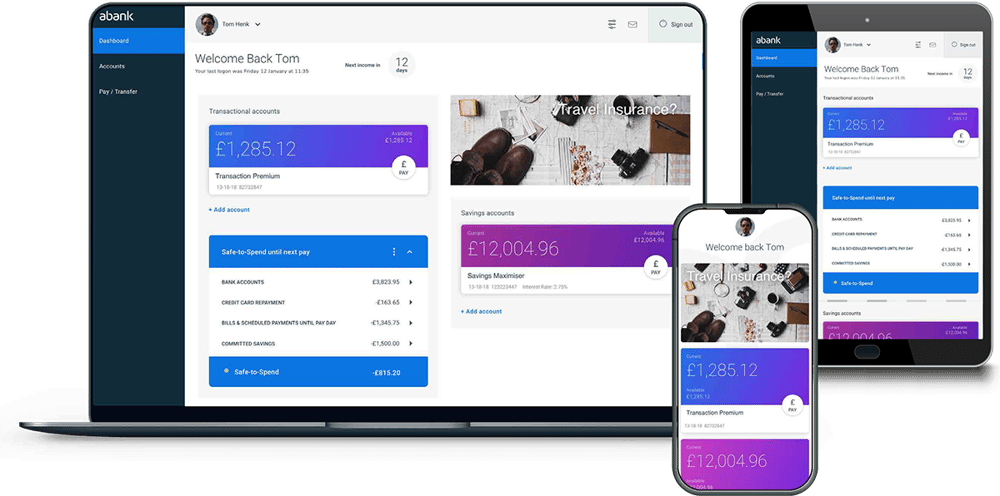

In a competitive environment, elevating your customers’ daily online experience can deliver the ultimate point of difference.

Transform the way you interact with customers, engaging them through a full set of banking functions on their device of choice, and you instantly begin to build more meaningful relationships.

BankFast is Sandstone Technology’s next-generation online banking solution. An out-of-the-box, extendable, end-to-end digital platform, BankFast delivers real value for your customers and staff, boosting trust and transparency. It also offers easy sharing of data with third parties in compliance with Open Banking standards.

Seamlessly integrating with your core banking, cards systems and other internal and external systems, BankFast gives your personal and business banking users fast, simple, secure access to daily banking services.

Delight your customers with an easy, engaging banking interface that lets them service their accounts online including actioning maturity instructions, and internal account opening.

Confirmation of Payee (COP) service is available for your personal and business banking customers with BankFast. COP is an account name checking service that helps to make sure payments aren't sent to the wrong bank or building society account.

To connect with increasingly digital and self-supervised consumers, banks need to give a more personalised experience, one that’s aligned with the customers’ own levels of financial wellbeing.

Key to achieving those objectives are the prefabricated personal and business banking experience and service modules that come with BankFast and BXP. Developed using trusted technology standards, these provide the flexibility to adopt, extend or build your own differentiated experience. And they signal the end of custom-built or inhouse applications which are often expensive, complex and channel specific.

BankFast and BXP will equip you to build enduring customer relationships and strong connections based on trust and transparency, delivering the agility you need to future proof your digital banking.