Broker Portal

Broker Portal

It’s not just customers who can benefit from automation and AI.

With around 80% of all mortgages in the UK processed through brokers, it’s absolutely imperative that we make their mortgage journey - as well as the customer’s, a positive one from start to finish.

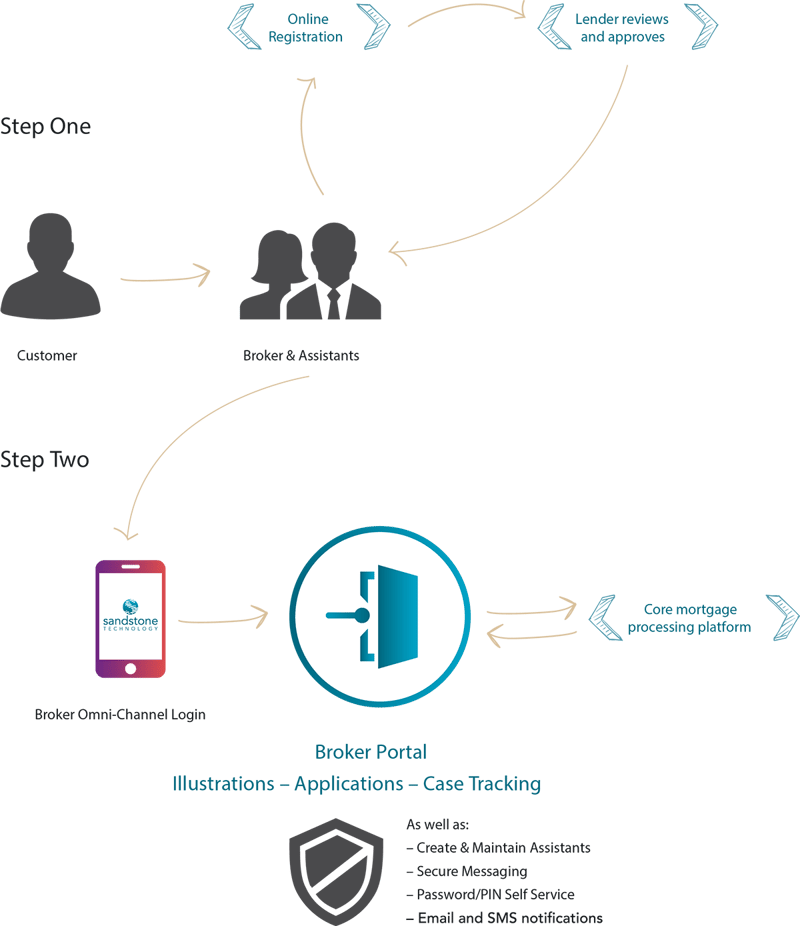

With Broker Portal, we’ve put our knowledge of the UK mortgage market to work, providing a seamless framework for application submission, illustration and offer delivery, case tracking and document submission. It’s an ever-evolving, market-leading solution that’s been adopted and embraced by brokers and banks.

Treat your brokers to a faster, less manually-intensive process with a simple registration form and less re-keying. Cases can be tracked in real-time and urgent cases prioritised, all using the broker’s device of choice.

Broker Portal gives quick mortgage deal illustrations and decision in principles, backed by real-time verification and credit decisioning, reducing time to offer. Customers enter data in real time and receive feedback, showing fees and payment amounts.

With end-to-end auditing and uploaded documents linked to underwriting requirements online, you’ll be more confident about compliance and risk. And it’s all carried out via a secure online channel

Where once mortgage staff were answering multiple broker enquiries on every case, a real-time application dashboard now sends automated progress updates and alerts. This frees staff up for value-adding tasks, which translates to more business completed by the same team.

Brokers who used to waste time re-keying data, can now quickly generate lending scenarios for different amounts. These can be rapidly progressed to decision in principle or full mortgage application – all using existing data. Meanwhile dynamic validation ensures better quality data.

Everything is done using online tools, from registration to full application, with all documents uploaded and downloaded through the portal. A broker can receive responses while they’re sitting with the client! And we’re not resting on our laurels: new Broker Portal features are deployed regularly and quickly to keep pace with market demands