Preventing the churn in banking: digital customer experience to the rescue

Posted by

Sandstone Technology on Aug 30, 2023 6:35:15 PM

Preventing the churn in banking: digital customer experience to the rescue

As digital natives enter the ranks of customers in their droves and challenger banks emerge with ever more attractive offerings, many financial institutions are facing a hard truth: they can’t bank on loyalty if their customer experience is sub-par. We outline some of the new digital experience imperatives in the battle to stop attrition.

Why do customers break up with their financial institutions? Sometimes it’s down to personal reasons out of the bank’s control – people relocating, changing jobs, buying property or going through relationship break-ups.

Some customers move to get better interest rates, swell their savings or reduce mortgage repayments. They may value certain features and benefits that are attached to specific accounts, like an overdraft or cash bonuses. They may have had a fraud incident handled badly by their bank; others are just tired of frustrating experiences generally.

Now is the time for real change. Every financial institution (FI) has control over the products they have in their portfolio, and the customer service they provide. In this digital age, there are numerous routes for upgrading the technology used behind the scenes, and enhancing the experience offered to customers on the front-end.

Bank branches have closed rapidly around the world. In parallel, many customers are migrating away from in-person interactions post Covid, preferring to transact from their laptops or phones. In that increasingly virtual environment, it’s more vital than ever to offer a positive digital experience.

Customers demand banking at their fingertips and better control over their finances, supported by a holistic, digital view of all their accounts and services. They want a unified, frictionless experience across all customer touchpoints.

They also want the convenience of self-service, 24/7, on a device that suits them: banking will never again be something that can be managed between 9 and 5, Monday to Friday. They want problems solved through one digital action, with no follow-up required through a phone call or branch visit.

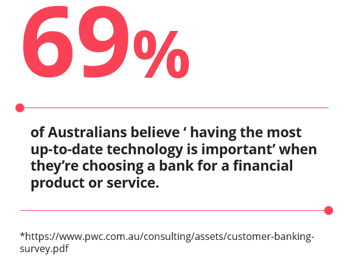

In Australia, customer expectations for better digital experiences are still being let down.

It is no longer acceptable for banks to offer the bare minimum of functionality on mobiles and online. The basics – e.g., checking account balances, transactions, and statements, transferring funds or paying bills – aren’t enough. Not when their competitors make it seamless and easy to do things like apply for accounts and loans online. They have chatbots to help answer easy questions fast. Some FIs enable customers to send money instantly in real time, including international payments, using their channel of choice. This kind of functionality is increasingly the expectation.

Globally, customers are voting with their feet when it comes to lack-lustre digital experiences. In the final quarter of 2022, the number of account customers using the UK’s seven-day Current Account Switch Service (CASS) was the highest since the initiative launched in 2013. Of the people who had switched, online banking was the main reason cited for preferring their new account, followed by customer service and mobile banking/banking app ease. This attrition is costing FIs dearly. According to American Bankers Association research, it’s five to 25 times more expensive to acquire than retain customers. Increasing customer retention rates by 5% can boost profits by 25% to 95%.

One 2022 Australian study found that while the customer experience quality of banking had declined significantly from the previous year, the customers who did feel valued rewarded their FIs for it. 90% planned to stay with their bank and 81% planned to spend more and advocate for it.

If FIs don’t get it right – if the digital experience is poor - people will go where it’s better. That’s especially true of Millennials. And Generation Z, who are reaching adulthood and increasingly becoming responsible for their own finances. Millennials and Zs are more likely to move bank after a bad experience – in fact 30% of Gen Z are more likely to change banks, a 50% increase since 2019. They have high expectations and low loyalty and won’t hesitate to look elsewhere to get the service they expect.

The silver lining in all this is that these younger customers are willing to pay more for a better experience. Regardless, there could be some troubling times ahead for FIs.

The pressure is definitely on to stay competitive, given the volume of customers switching bank provider every month. Simpler digital/online origination processes are just making it easier for people to jump ship; meanwhile aggressive acquisition campaigns offering incentives and enticements for people to bank with new providers have eroded loyalty even further. In the UK, high switching totals towards the end of 2022 align with a number of strong incentives and offers from new providers – including cashbacks. Neobanks in particular are fast disrupting the banking landscape from all angles. And they’re not going away. The global fintech market is projected to grow to more than US$330 billion in 2028, and many of the new players regularly achieve record-high satisfaction scores for their banking experiences.

Neobanks in particular are fast disrupting the banking landscape from all angles. And they’re not going away. The global fintech market is projected to grow to more than US$330 billion in 2028, and many of the new players regularly achieve record-high satisfaction scores for their banking experiences.

These results aren’t surprising, given digitally-native FIs offer banking solutions that have been purpose-designed for user experience rather than being optimised for smartphones retrospectively. If you’re a traditional bank that is slow to adopt digital technology, these new players are making it harder for you to appeal to the younger demographic.

After the pandemic, the uptake of digital accelerated across all demographics including older generations, a trend which has stuck. Ultimately, it’s not just Gen Z and Millennials who will experience dissatisfaction with poor experiences.

FIs that don’t fix the digital experience now, for the benefit of all age groups, will struggle in the race for digital acquisition. Banks need to focus on creating seamless digital interactions and make sure they’re meeting the needs of both their current customers and the customer of the future.

It might mean an overhaul of your core banking platform, or the integration of strategic apps, depending on where you are in your digital transformation journey. There might be a project to break down silos required, adoption of cloud options, or even managed hosting services.

The end game is to boost your ability to innovate and bring new digital products to market faster. If you’re ready to invest in boosting customer experience, building more loyal customer relationships and reducing attrition.

It is impossible to discuss the role of AI in financial services without highlighting that 2020 was hugely disrupted by COVID-19 and the ripple effect is expected to last for years...

.png?width=1280&height=807&name=shutterstock_440065846%20(1).png)

As big data becomes a fact of life for both consumers and banks, it introduces new avenues for creating revenue streams...

Fintech digital transformation can be made much simpler if partners are willing to drive value in the direction of their customers. With more innovation taking place in the industry, the ability to meet the customers' need is what sets a company apart from the rest...