THE CURRENT PANDEMIC AND IMPACT ON SMEs

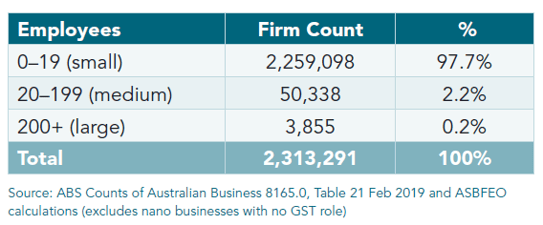

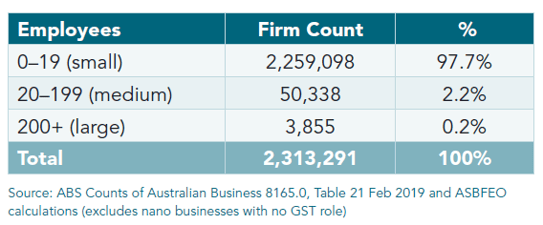

In 2019, small businesses accounted for 35 per cent of Australia’s gross domestic profit and employed 44 per cent of Australia’s workforce. As defined by the Australian Bureau of Statistics (ABS), a small business is an entity employing less than 20 employees, whereas a medium size business employs 20 -199 people. Of the 877,744 total employing businesses in 2019, 823,551 were small businesses (93.8 per cent), and of those businesses, 627,932 are businesses that employ only 1-4 people, known as micro businesses (76.2 per cent).

A high level overview on the number of businesses as per the 2019 report from ABS is provided below. It can be observed that a significant number of small businesses were sole traders (62 per cent) with no employees, micro business (1-4 employees) account for 27 per cent and small businesses (5-19 employees), 8.5 per cent.

Recent ABS data tells us 900,000 businesses are getting JobKeeper payments and about 690,000 businesses have received cash flow boost assistance from the government, while 38 per cent of businesses still trading have renegotiated their rent arrangements, and many have delayed payments on bank loans. Sadly, ABS data also tells us about 200,000 small businesses stopped trading in response to the crisis by the time JobKeeper was announced. Two-thirds of businesses were still reporting reduced revenue in June, and of those businesses, approximately one third were reporting revenue losses of 50 per cent or more.

Recent ABS data tells us 900,000 businesses are getting JobKeeper payments and about 690,000 businesses have received cash flow boost assistance from the government, while 38 per cent of businesses still trading have renegotiated their rent arrangements, and many have delayed payments on bank loans. Sadly, ABS data also tells us about 200,000 small businesses stopped trading in response to the crisis by the time JobKeeper was announced. Two-thirds of businesses were still reporting reduced revenue in June, and of those businesses, approximately one third were reporting revenue losses of 50 per cent or more.

This impact will continue to be felt by small businesses until a permanent solution is found to address the pandemic. It also means there is still a risk more businesses may not be able to trade out of these changes in market conditions. However, there are still a significant number of businesses that will continue to require support from the government as well as their financial institutions to see the other side of the pandemic. The operating model of businesses has also been forced to change due to social distancing and other health related regulations, including lockdowns, and many of them have put a greater focus towards adopting digital technologies such as digital contactless payment systems, online ordering facilities, and delivery mechanisms.

SME relationship with banks

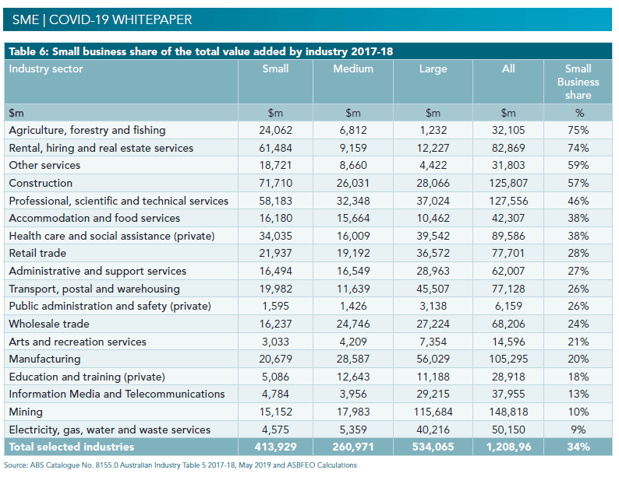

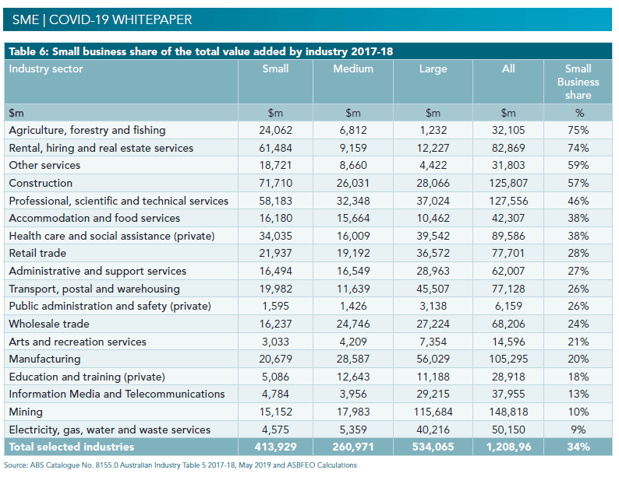

Traditionally, big banks don’t always offer the products, services and technology that is needed by the small business segment. The focus for the big banks has been on servicing the retail segment (high volume) and enterprise / corporate segments (high and stable profits), whereas the offerings for SME segment hasn’t kept up with the needs of the market. The SME segment is quite diverse (refer to the ABS table from 2017-18) and there are few sectors where SME are the dominant segment, such as agriculture, rental, hiring, construction, professional services, accommodation and food services. A few of these sectors, especially accommodation, transport, and to the arts, have seen a significant negative impact due to pandemic vis-à-vis the others.

Areas of friction while using financial services

According to a 2019 survey of 1,750 business owners nationwide, commissioned by SME lender Judo Capital and conducted by East & Partners, they found that Australian SMEs are facing a worsening national credit crisis, with the “funding gap” for businesses with a turnover of up to $20 million ballooning over the past

12 months from $83 billion to $90 billion. The Judo research found that the average SME applied for $800,000 in new borrowings in the last year, with those that successfully obtained finance securing $600,000 in new credit, while the average unsuccessful credit application was $1.1 million.

According to respondents, the main reason SMEs were prevented from accessing credit in the last year was as a result of collateral requirements (34 per cent), slow turnaround times (16 per cent), inappropriate terms and structure (11 per cent), interest rate (8 per cent), and an unsatisfactory credit rating (4 per cent).

As a result the SMEs level of trust in the major banks continues to plummet. On a scale of 1 to 10, where 1 indicates mistrust and 10 indicates complete trust, the average rating SMEs gave the big banks has dropped to 2.27. The SME credit crisis is just one example of how this market segment feels they have been let down. Other areas where the bank’s current service offerings are not meeting the expectations of SME segment can be found on the next page.

Click to download the full whitepaper here.

-

Origination Processes

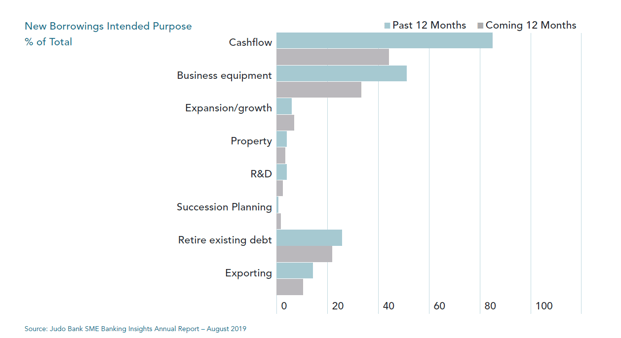

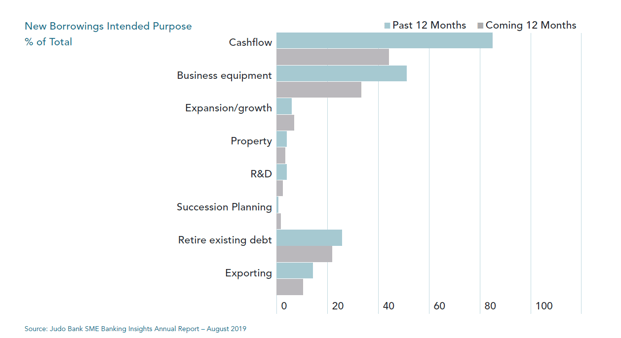

Long lead time for account opening or applying for loans, top-ups, deferrals, etc. may be due to manual processes around document collection, verification, or credit validation and approval processes. Even the Covid-19 pandemic related government support needs to be made available to the SME segment with ease. If we look at the intended purpose of SME borrowings (as per the Judo Bank 2019 Survey report) and map it to the delays in origination processes, it highlights the impact it can have on new business activities, the cashflow for businesses and even some of the R&D activities.

-

Payments Processing

A 2018 Deloitte Report has found that significant value can be unlocked for SMEs by making or receiving payments strategically in a manner that attracts rewards, improves working capital, drives efficiency or optimises processes. There have already been serious discussions around banks not having enabled least-cost routing for merchants, which can lead to higher transaction costs for the merchants. Even the real-time payment

capabilities, or New Payments Platform (NPP), is still not offered by some of the banks. NPP can assist in getting immediate access to funds in a bank account to make urgent supplier payments or bills or meet other expenses. With the pandemic, there has been a much greater need for digital and contactless payments not only for the consumers but also for the SME segment. Some of the financial institutions are still lagging

in offering such capabilities. There is also a greater need to look at innovative solutions that can facilitate

digital payments at a lower cost, for example, can the EFTPOS device capabilities be made available through smartphones or tablets?

-

Lack of Financial Insights

Even though the SME segment is diverse, the fundamentals of cash flow management, working capital management, managing payables & receivables apply across the businesses. Lack of meaningful insights from the banking services provider makes them look for third party tools or even add to their manual tasks.

-

Lack of Knowledge Base

SMEs expect support and guidance from their financial institutions during their business lifecycle journey. Their needs are different across different phases of their business growth and at times the knowledge base or guidance available through the bank websites may not meet their expectations.

With the pandemic biting into many of these small businesses, this segment is looking at every option around cost savings and managing their cash flow effectively. They are also looking at their financial institutions to guide them through options available in order to keep their businesses as a going concern.

Banks can enhance the experience for the SME segment by leveraging digital channels

Digital channels such as online banking and mobile banking apps are the key interfaces between the SMEs and their financial institutions for all business banking related issues. As a banking partner to financial institutions servicing the SME market, there are multiple opportunities for banks to enhance the overall experience for this industry segment using these channels. Multiple businesses have been impacted severely by the Covid-19 pandemic, however some of them can re-emerge in a position of strength if adequate support is provided. Banks need to identify those opportunities and enhance the digital customer experience to build customer stickiness and grow with them. There are quite a few other businesses that have seen good growth during the pandemic. Enhanced digital offerings from banks may encourage many SMEs in switching their bank provider based on the improvements of their products, services, and technological advancements.

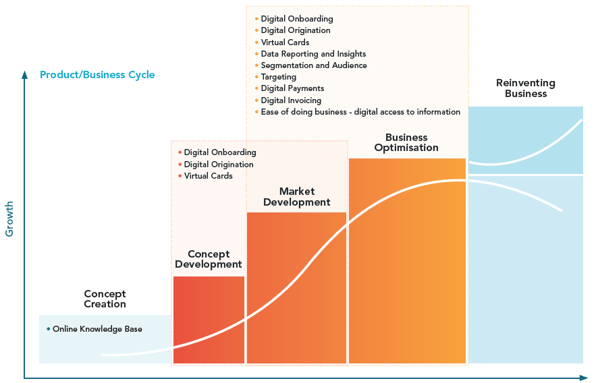

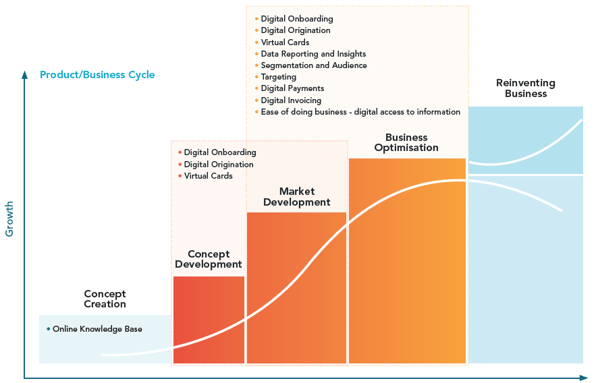

A lot of initiatives are already underway across different banks and there are quite a few other digitisation initiatives that can be considered factoring in the business life cycle of the SMEs (refer to the chart below).

-

Simplifying Onboarding and Origination Processes

Banks can look at eliminating manual processes during the on-boarding stage of the lifecycle. For example, banks can leverage Optical Character Recognition (OCR) to scan documents, use AI and ML capabilities to interpret the data and integrate with credit score providers or ID verification providers to reduce the overall cycle time to grant a loan or to open an account. Additionally, these capabilities can be integrated with mobile banking apps or within online banking platforms, thereby improving the overall customer experience. The current pandemic has seen a surge in demand for loan deferrals, interest rate switches, etc and these can be integrated as part of the customers digital banking experience.

-

Card Issuance, Controls and Digital Wallet

Cards can be one of the means of short-term financing for small businesses and banks can potentially look at digital issuance to make the cards immediately available. Additionally, delegates or secondary users can be added to the card, thereby allowing employees to use the card for everyday business expenses. A virtual card also assists in controlling spend, reduce the risk of fraud and make reconciliation processes easier.

Click to download full whitepaper here.

Applying card controls enable SMEs to have control on where and how business cards are used by employees. Options around blocking merchant categories or even setting limits and alerts can enable businesses to keep track of card usage. Enabling Digital Wallet is yet another capability that can make the overall experience smooth as it can eliminate any need to carry a physical card.

Managing cash flow is critical for small business and no one likes to wait for 2-3 working days for a payment to appear in their account. Banks should look at making the real time payments platform, NPP, available to their business customers. It can at least allow them to receive funds in realtime as well as make payments to their suppliers in real-time provided their bank has enabled NPP as well. Even some of the batch payments processing such as Payroll processing can be done in real-time through NPP. Cross border payments through digital channels is a standard offering across banks and the Financial Institutions working with the SME segment should ensure that this is not a feature gap as it provides the SME customers the convenience to deal with international transactions. Companies like TransferWise are offering borderless accounts and providing such capabilities can transform the experience of SMEs with international supply chain.

-

Data Reporting and Insights

Banks have a complete view of transactions of their customers and with open banking they can also initiate consent to obtain details of banking transactions with other banks. This data can not only provide valuable insights to bank in case they are doing any credit assessment of their customer, it can also enable them to provide meaningful reports to their customers. Banks can build or buy tools or leverage fintech partnerships that can allow SMEs to better understand their financial position such as income, expense and other operational indicators. Categorisation of transactions can provide them a viewon the type of expenses and enable them to optimise / control if they are looking at cost control. The digital channels such as mobile app and online banking can

provide financial health indicators to the customers in the form of dashboards and meaningful reports.

-

Digital Invoicing

As per a recent report from VISA on “Digital transformation of SMEs: The Future of Commerce”, digital invoicing has been highlighted as an area of keen interest for SMEs, providing a route for income to be received from customers and for suppliers and vendors to be paid in order to, ‘keep the lights on’. The report highlighted that across SMEs, there is consensus that sending and receiving digital invoices confers tangible benefits such as, 80 per cent of respondents agreed that the cost of sending invoices is reduced compared to paper invoices (e.g. saving on paper, printing and postage), and 82 per

cent also agreed that there are time savings. Vitally, 78 per cent of SMEs somewhat or strongly agreed that they receive money faster from customers via digital invoices, compared to paper.

While some of the sizeable businesses can look at third party software such as Xero to send digital invoices, there are still a large set of small businesses or micro-businesses that can latch-on any offerings provided by their Banks. This capability can be provided by banks either through inhouse development or leveraging the capabilities of fintech partners. Banks can further look at embedding the experience as part of digital channel experience, for example in-app invoicing.

-

Ease of Doing Business

Banks can enable businesses in areas such as taxation. For example, banks can provide digital vault solutions as part of digital channel offerings, where customers can scan and store receipts. These can be scanned and read for GST obligations at the time of taxation. Business profile sections within digital banking can provide taxation details or even have integration with myGov that can make it easy for businesses to manage their tax obligations. Banks can also enable integration with Accounting software used by SMEs to capture data that can not only simplify tax management experience but also enhance financial insights.

-

Audience Targeting

The SME segment is diverse, and the needs varies as per the industry sector or even the business life cycle. Banks can also apply customer segmentation criteria and use the digital channel coupled with content management portals to run specific campaigns, or even create Wikis to provide the knowledge base that their customer may be looking at. The segmentation process can also be used to customise product offering to this segment.

Conclusion

The current pandemic has impacted some industry verticals significantly and the SMEs operating within those industries. The traditional relationship-based model is also giving way to digital interaction. Existing online banking and mobile app channels are key interfaces that banks can further leverage to enable ease of doing business and provide the supporting hand that the SME segment need to come out of this recession. There are a wide range of options available for banks to enhance their digital offerings – build in-house solutions on digital channels, leverage the platform capabilities and innovative services of their vendor and partners, or form partnerships with fintechs to bring in specific capabilities. It’s essential that the banks start addressing their services gap to retain and grow their customer base. There are already existing threats in the market place such as the growing competition from neobanks, and some of the larger banks that are using fintech partnerships to bring in SME specific solutions.

A Financial Institution’s business strategy around how they approach the SME segment will ultimately determine their success in meeting the needs of this market. Understanding the needs not only of the medium to larger players within the commercial and corporate space, but the smaller end of town, will open up new opportunities for growth. However, in order to meet those needs your digital transformation strategy must come first. Being able to offer the digital tools required by this market segment to meet not only their immediate business needs, but those of their customers will ultimately drive customer acquisition.

This whitepaper was authored by Ranjan Kumar, Product Consultant – Digital Banking at Sandstone Technology. Ranjan has over 15 years of program management and business consulting experience within the finance and technology industries. For further information contact the PR and media at media@sandstone.com.au.

References:

• www.asbfeo.gov.au

• https://www.asbfeo.gov.au/about/quarterly-reports

• https://www.slideshare.net/vsolodkiy/12-neobanks-for-smes-and-gigs?from_action=save

• https://bankinnovation.net/allposts/operations/cap-fund/german-sme-challenger-bank-penta-raises-2-7m-seed-funding/

• https://www.virtusa.com/perspective/social-distancing-a-catalyst-for-digitalization-of-sme-debt-management-process/

• Deloitte Report: SME Digital Payments |New opportunities to optimize |The Paytech Revolution Series | 2018

• Digital Transformation of SMEs: The Future of Commerce, Visa Report, 2020

Click to download the full whitepaper here.

Recent ABS data tells us 900,000 businesses are getting JobKeeper payments and about 690,000 businesses have received cash flow boost assistance from the government, while 38 per cent of businesses still trading have renegotiated their rent arrangements, and many have delayed payments on bank loans. Sadly, ABS data also tells us about 200,000 small businesses stopped trading in response to the crisis by the time JobKeeper was announced. Two-thirds of businesses were still reporting reduced revenue in June, and of those businesses, approximately one third were reporting revenue losses of 50 per cent or more.

Recent ABS data tells us 900,000 businesses are getting JobKeeper payments and about 690,000 businesses have received cash flow boost assistance from the government, while 38 per cent of businesses still trading have renegotiated their rent arrangements, and many have delayed payments on bank loans. Sadly, ABS data also tells us about 200,000 small businesses stopped trading in response to the crisis by the time JobKeeper was announced. Two-thirds of businesses were still reporting reduced revenue in June, and of those businesses, approximately one third were reporting revenue losses of 50 per cent or more.