Open Banking - looking beyond data sharing

Posted by

Sandstone Technology on Sep 21, 2020 11:21:29 PM

Topics: Digital Banking, Data & Open Banking

Open Banking - looking beyond data sharing

The Open Banking deadline is nearing for Data Holders, the major banks have already complied with product reference data, whereas non major ADIs including nonmajor banks, building societies and credit unions, are well set to comply with these requirements by Oct 1st, 2020.

While the compliance timelines for disclosure to accredited data recipients is still a few quarters away (phase-1 for major banks is Oct 2020 and for non-major banks/ADIs/ building society/credit unions is July 2021), the financial institutions have also started to define their strategy around being a Data Recipient. We are seeing a varied set of approaches to the Open Banking Consumer Data Right (CDR) compliance requirements.

While the smaller financial institutions have primarily focused on compliance aspects, the mid-large tier organisations have taken a strategic approach to prepare themselves for a new world, where the customer and banking data can be potentially accessible to all financial institutions based on customer consent.

While the immediate focus of CDR has been product, banking and consumer data from Financial Institutions, it is expected to be extended to other industries such as utilities. Additionally, the Australian Competition and Consumer Commission (ACCC) is also contemplating ‘write access’, which can open up transaction processing by Data Recipients post receiving customer consent.

Operating in an environment in which open access to banking product data is permitted can benefit customers with an enhanced digital experience, by providing the best value

for the products they are subscribing through their financial institution. Financial Institutions can potentially look at a host of opportunities in the Open Banking regime, such as:

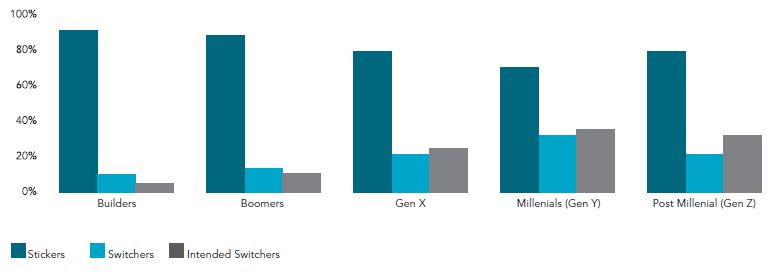

Just sharing data with other Financial Institutions in a Data Holder model may not be an effective strategy for any Financial Institution. It poses serious risk to the very business they are in given the customer can switch products based on the services and best value they may get from other institutions. Digital savvy Millennials and Gen Z are much more open to such switching given that products can be applied for and approved digitally within minutes. Hence, taking no action is an immediate business risk.

A range of operating model / solution approach are being adopted by Financial Institutions to become ready for the Open Banking world. They are looking at a mix of approaches such as building inhouse capabilities, partnering with Fintechs and other vendors, investing in early start-ups and Fintechs, and partnering with technology companies.

Few of the Financial Institutions have been redefining their existing Digital Banking architecture and looking at various mechanisms such as building Data Lakes, identifying performance bottlenecks and bringing in concepts around the speed layer.

Banks like NAB have invested in Fintechs like Basiq, where they are using the specific APIs and analytics offering provided by the Fintech to provide value add services to their clients.

Some of the Financial Institutions have created separate ventures or platforms to continue innovating and be ready for the Open Banking world. CBA has launched X15 Ventures aiming to get five Fintech businesses up and running over the course of this year alone. They have partnered with Microsoft to drive this venture.

Topics: Digital Banking, Data & Open Banking

Open Banking drew global attention in 2016 as a direct result of the UK’s Competitions Market Authority announcing plans for the top 9 banks in the UK...

Covid-19 has significantly transformed our lifestyle on multiple fronts. From the way we do our professional work...

It’s time to change your perspective – it’s no longer ‘digital banking’. It’s ‘banking in a digital world’...