Open Banking and the stigma of regulation in the UK

Posted by

Sandstone Technology on Nov 24, 2020 9:16:55 PM

Open Banking and the stigma of regulation in the UK

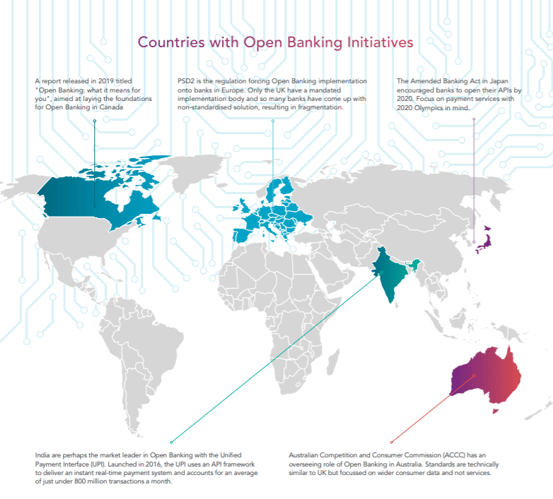

The term Open Banking started to gain notoriety in 2016 as a direct result of the UK’s Competitions Market Authority announcing plans for the top 9 banks in the UK to deliver open source APIs for 3rd party use by January 2018. Open Banking has been introduced in many countries around the world with varying regulatory controls. As a result, Open Banking is now seen by many in the industry as a compliance project and is facing internal resistance.

However, this needn’t be the case. Opportunities exist for banks and financial institutions across the globe should they embrace Open Banking and see beyond the regulatory framework. This report sets out to remind us of what Open Banking is, where it can be beneficial and explain why it hasn’t been the innovative explosion everyone was hoping for.

Open Banking today means different things to different people around the world. For fintechs it is the ability to provide additional service offerings to both the bank and the end consumer through consent, automation and digital experiences, such as a bank-controlled consumer portal.

For banks, it is a costly piece of regulation that poses a threat to their much-valued customer relationship. For most consumers, it is relatively unheard of. Those that have heard of it are confused by the mixed messages from banks regarding sharing personal data.

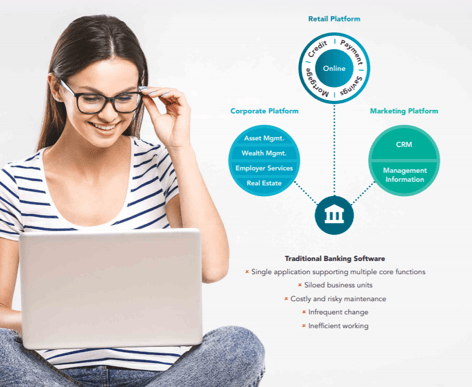

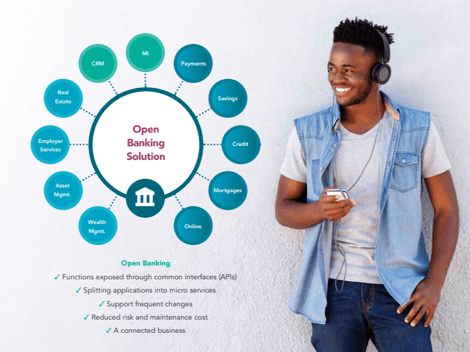

All these descriptions have some truth to them, but Open Banking is much more. It is about banks digitising their business, turning their siloed software into accessible services that can be more efficiently used, both internally and externally.

Open Banking is essentially a concept known in the technology world as “Everything as a service” (XaaS), which is a design approach that enables software to expose its functions to other software, so that a business can operate more efficiently. This software design approach typically results in Application Programming Interfaces (APIs).

Open Banking is essentially a concept known in the technology world as “Everything as a service” (XaaS), which is a design approach that enables software to expose its functions to other software, so that a business can operate more efficiently. This software design approach typically results in Application Programming Interfaces (APIs).

An example of XaaS might be a piece of HR software that requires employee’s payroll data, which is currently stored in the company’s payroll software. If both the payroll and HR software used XaaS in their designs, then HR would be able to directly pull the information from payroll as and when it is required, using an API.

However, many legacy systems do not support XaaS and therefore a cumbersome, error prone, manual process is in place to import payroll data into HR once a month.

A perfect example of how a company has successfully adopted XaaS within its business model is Amazon. Amazon evolved from providing an online retail environment to boasting a $7.7 billion cloud-based platform business today.

It is said around 2003 Amazon CEO, Jeff Bezos, sent a memo to his staff stating that moving forward all Amazon teams would expose their data and functionality through generic interfaces (APIs) to be used by any technology – internally or externally. During the years that followed Amazon further developed its own IT infrastructure, one that better suited their internal business needs. With the original intention in mind of sharing data to achieve business objectives, Amazon were able to capitalise on their internal systems, marketing this solution to the outside world.

Amazon has proven that a successful implementation and business strategy based around XaaS can positively impact

your business. When directly translating this across to Open Banking, the potential benefits include:

Operational efficiencies

– Cost savings

– The creation of digital revenue streams

– Utilising existing software to create new innovative services

– Enhance the customer’s experience

With these available opportunities on offer, it’s a wonder why banks are not interested in embracing Open Banking more.

Governments around the world, recognising that financial data belongs to the individual and not the bank, have started introducing legislation to force banks to provide their services externally to authorised third party providers (TPPs). In the EU it was PSD2 and the legislation was known as common secure communication. It focusses on providing both account information and payment services for payment accounts. In some countries, regulation encompasses more account types but focuses solely on account information. Many have labelled this legislation as Open Banking and it has unfortunately stuck. Externalising services to TPPs is a subset of Open Banking.

Banks that fall under the legislation have an obligation to comply before a certain date and so for many their only concern is to comply in time and so any Open Banking conversations are kept within the confines of regulation until banks are compliant. Banks that don’t fall under the legislation dismiss Open Banking as something that doesn’t concern them and therefore do not explore its opportunities.

Regulation hasn’t helped with consumer uptake either. The customer journey imposed on TPPs, thanks to PSD2, and the lack of a refund service for third party payments, are some examples highlighted in a published UK Open Data Institute report.

Banks that don’t fall under the legislation dismiss Open Banking as something that doesn’t concern them and therefore do not explore its opportunities.

It is no secret that digital transformation is a complex and costly exercise. Traditional IT systems that provide end-toend solutions are expensive to transform away from and present high operational risk too, since they are often atthe core of business process.

Furthermore, providing secure external APIs to third parties is a complex task. Software providers offer Open Banking components, but few provide complete solutions. Therefore, in a lot of cases banks are having to engage with multiple providers, learn the trade-off points between them and manage the delivery. This endeavour comes at a price, as banks are having to upskill and invest in technologies, which until recently were technologies primarily used by enterprise businesses.

Banks see the legislation as a major threat to their highly valued customer relationship. Selling products through branch visits is close to disappearing. For their online services to also be under threat makes for an unsettling future for banks and so any bank not regulated will, understandably, not want to explore Open Banking.

Banks are not the only entities to fear Open Banking. Consumers who, for a long time, have been told not to trust anyone with their bank details are now being told the reverse. Though a lot of investment has gone into making Open Banking secure, this is not obvious to a customer. There is a lot of education required to help consumers adopt Open Banking, coupled with online and mobile apps that make saying no difficult.

Despite the concerns there are many opportunities worth exploring for banks.

We used the HR and payroll example earlier on, but how many other business processes could be streamlined by opening access through APIs? The efficiency that could be gained from more streamlined processes could drive down operational costs and increase staff utilisation.

Open Banking allows banks to take advantage of another bank’s services. Savings banks can now access the account

information of a nominated account, enabling them to identify savings opportunities from transactional data. Furthermore,

using the payment services offered in the EU savings banks can use Open Banking to action a bank to bank withdraw

from nominated accounts, creating that much desired closed transaction loop.

Amazon would have never perceived the idea that they would be able to one day commoditise their IT infrastructure into a multibillion-dollar business. Though it might be hard to see now, what services exist within a bank that could be commoditised? The UKs Open Banking group (OBIE) have started exploring the development of premium APIs. APIs that could be monetised.

One area which might be worth exploring is data. Today data is also a multibillion commodity. So do opportunities exist

for banks to benefit from sharing anonymised data sets?

PSD2 came into force in September 2019. Following on from PSD2 are new initiatives such Confirmation of Payee and Request to Pay, both adopting APIs as the method for exposing services externally. Already third parties are lobbying to bring non-payment accounts under the Open Banking regulation. Until such time, account aggregation services will never recognise their potential. Therefore, it is better for banks to embrace Open Banking sooner, rather than wait until they are under pressure from their regulators.

Since the term Open Banking is now so closely attached to regulation, it is perhaps no longer appropriate to be used as a description for a bank digitising their business. Perhaps a more appropriate term would be ‘Banking as a Service’

Instead of banks looking at digitising as a strategic goal, they should instead look at how digitising can support their strategic business goals.

Instead of banks looking at digitising as a strategic goal, they should instead look at how digitising can support their strategic business goals. Whether a bank’s strategy is to drive down operational cost while increasing productivity, onboarding more customers, being more socially responsible, or improving their customer experience, banks should take the time to identify where the digital transformation of their business can help. Once a bank has identified where digitisation can accelerate achieving their strategic goals, they can develop a digital roadmap - where they want to be in the future and how they plan to get there.

From a regulation perspective, it will almost certainly increase competition within the banking space, and it is anticipated future regulation will bring more banks into the Open Banking ecosystem. Banks, therefore, need to decide how much to invest. Choosing to only comply could ultimately see a bank lose their much-valued customer relationship. Whereas choosing to go beyond and embrace Open Banking could be a decision that proves to be successful in the long term.

Open Banking drew global attention in 2016 as a direct result of the UK’s Competitions Market Authority announcing plans for the top 9 banks in the UK...

Covid-19 has significantly transformed our lifestyle on multiple fronts. From the way we do our professional work...

It’s time to change your perspective – it’s no longer ‘digital banking’. It’s ‘banking in a digital world’...