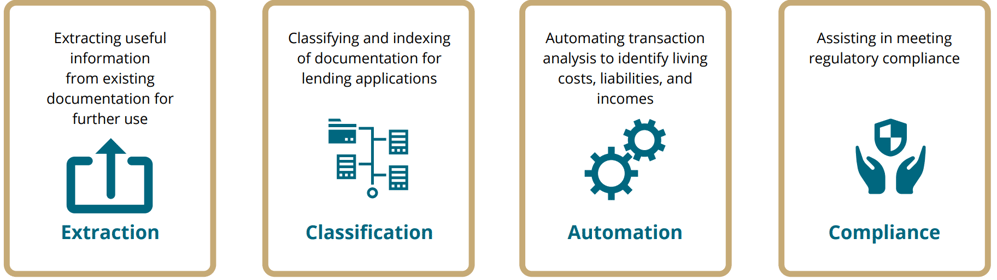

IDP is a set of technologies that can be used to understand and turn unstructured and semi-structured data into a structured format.

More than optical character recognition (OCR), IDP uses artificial intelligence (AI) technologies, machine learning (ML) and natural language processing (NLP) to capture, classify, and extract unstructured and semi-structured data. Intelligent Automation (IA) technology can then be applied to the extracted data for enhanced validation and to automatically enter it into existing applications.

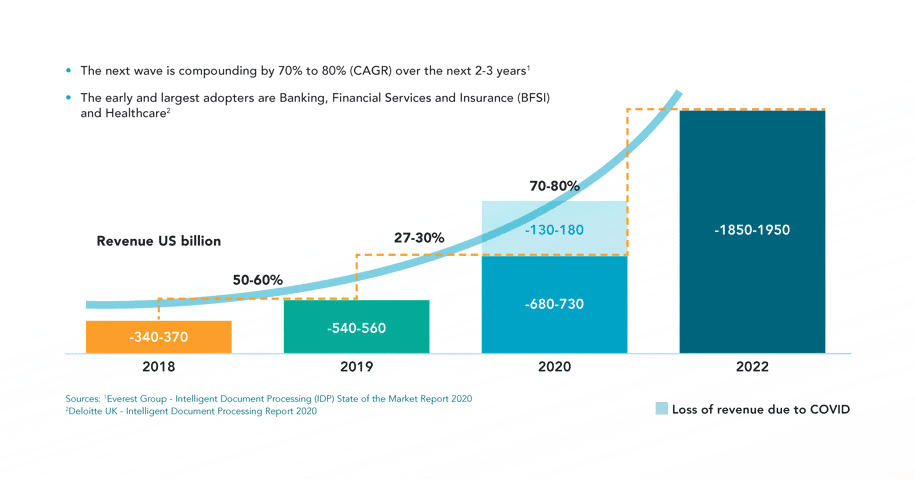

The adoption of IDP is growing at a Compound Annual Growth Rate (CAGR) of 70-80% over the next 2-3 years, with the finance services industry being the number one adopter. This early adoption is systemic of the amount of documentation and data being consumed within the banking process. According to Everest Group, the IDP market was expected to reach USD $1.1 billion in 2020 as businesses adopt the technology to maintain compliance and simplify data processing – especially large volumes of data.

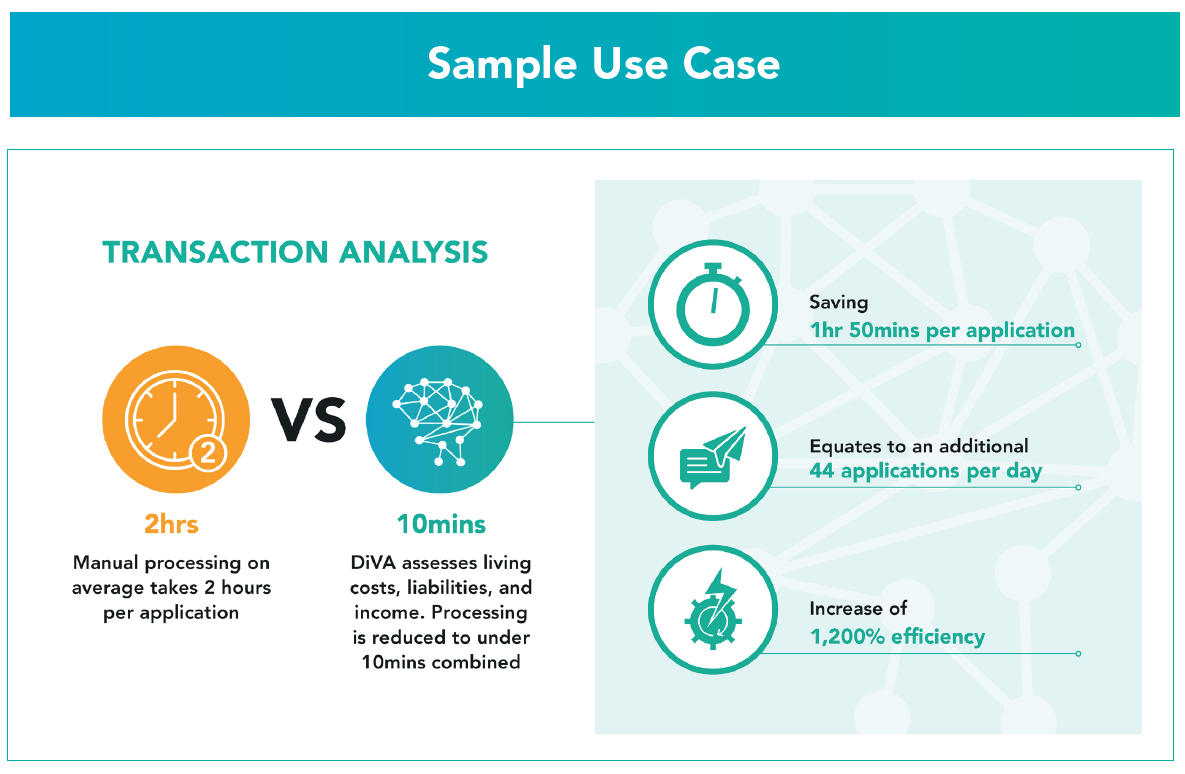

Data verification manual processing

1hrs / applicationTransaction analysis manual processing

2hr / applicationDiVA - data verification and transaction analysis

20minsFTE savings per year

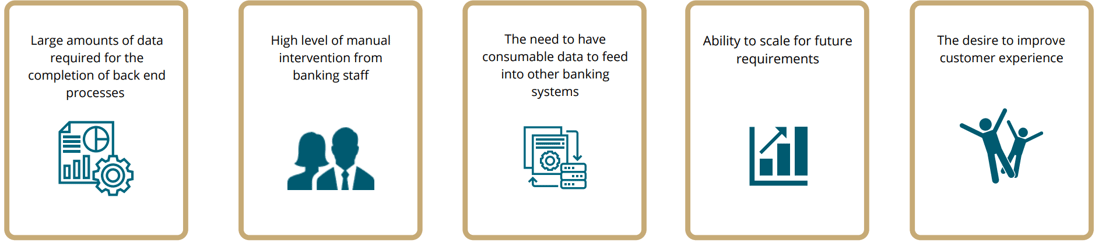

As specialists in the financial industry, Sandstone has built DiVA's enforced rules engine with no code configuration required.

With custom built AI designed to specifically service the finance industry, DiVA is already proficient in absorbing a vast number of financial document types to include pay slips, bank statements, contracts, bills, and many more.

Discover how DiVA can help manage your IDP.

To learn about additional sample use cases download the infographic or request a demo.

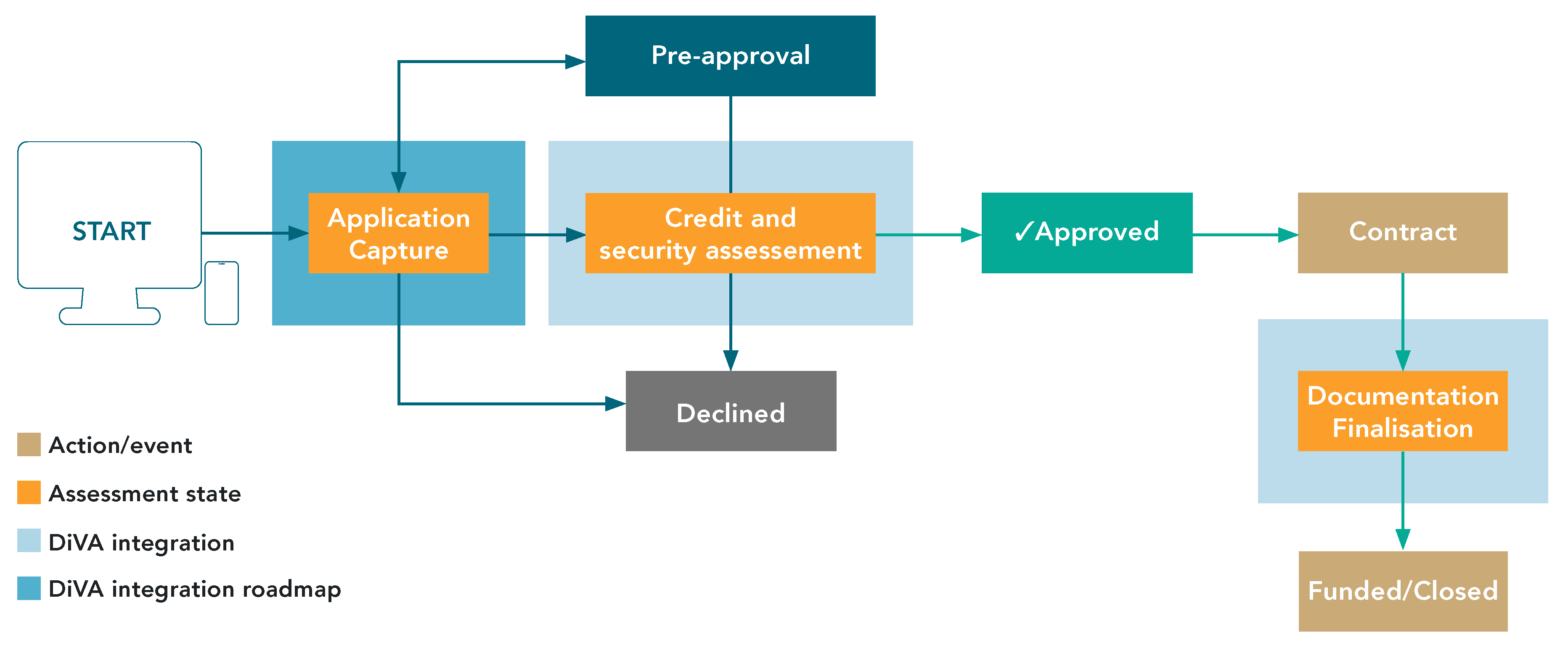

Within the loan application submission and approval process, DiVA is consumed by the bank or financial institution’s origination platform at multiple stages during processing.