P&N BANK TRANSFORMS ITS END-TO-END LENDING EXPERIENCE

By harnessing feedback from their customers and examining the performance of its processes, P&N Bank identified some significant opportunities to transform its customer experience by embracing digital technologies and ways of working.

The bank embarked on a major service re-design of its digital personal loan and credit card application user journeys, with the aim of removing points of friction, improving applicant visibility and transparency and, most importantly, reducing application wait times through improved process efficiency.

In collaboration with the team at Sandstone Technology, P&N Bank identified, scoped, estimated and planned the delivery of over 25 major features to its digital lending origination platform, powered by Sandstone Apply's Application Tracker and LendFast Origination applications.

These enhancements culminated in an upgraded loan application system for P&N Bank’s customers, which aimed to make the online lending application experience easier to navigate through:

Warren Wallis, P&N Group Chief Information Officer

P&N Group Chief Information Officer, Warren Willis, said that listening to customers and internal users to get feedback and being able to turn that into action and change in a timely manner underscored the importance of building mutual trust with our key vendors.

“LendFast is critical to our success in originating and processing retail loans, and leveraging the relationship with Sandstone to deliver such outstanding success is a case study

for that trust,” Warren said.

Sandstone’s Executive GM of Origination, AI & ML, Poli Konstantinidis, added “Our strong partnership with P&N Bank developed over 14 years, has enabled our continued focus

on collaboration, innovation & growth. As a result, together we have provided a solution which not only offers strong functional capabilities across the end-to-end credit origination

journey, but also focuses on an engaging customer experience that will help the bank differentiate itself from its competitors.”

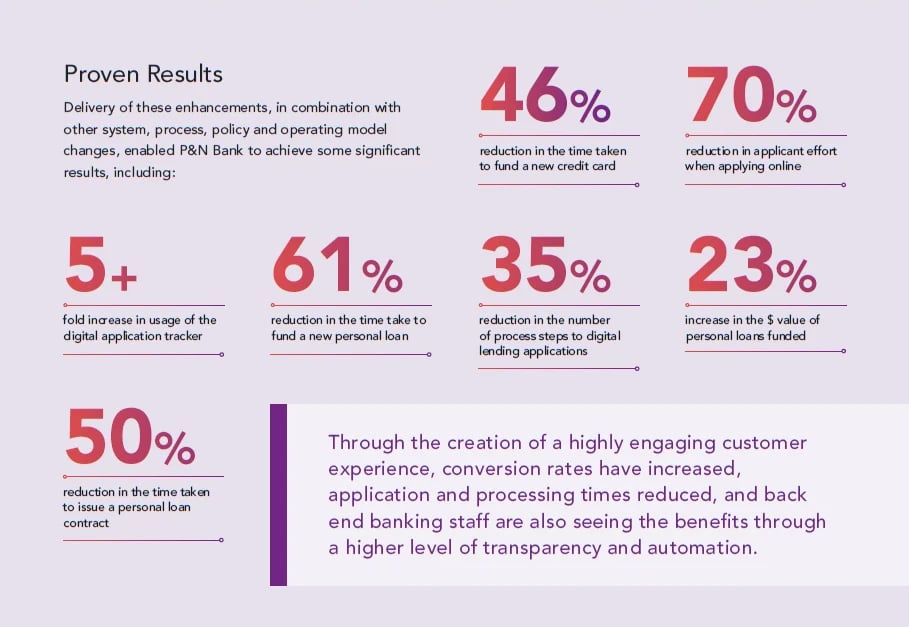

Through the creation of a highly engaging customer experience, conversion rates have increased, application and processing times reduced, and back end banking staff are also

seeing the benefits through a higher level of transparency and automation.

With plans to further enhance the automation and processing capabilities, Sandstone and P&N Bank look forward to a collaborative and rewarding relationship moving forward.