A View Based on Retail Customer Segmentation

Covid-19 has significantly transformed our lifestyle on multiple fronts. From the way we do our professional work, go about our daily responsibilities to planning or managing finances, we all have been pushed to adopt digital technologies. ATM cash withdrawals and footfall at physical bank branches are down, whereas e-commerce and contactless payments have increased significantly. A recent article in the Sydney Morning Herald, pointed out that the ATM usage in recent months has plunged by about 40% in volume compared with last year, while branch traffic fell about 50% from February to April. Contactless payments, in contrast, are up about 65% in value. Australians are showing a greater preference for contactless payments during the Covid-19 pandemic, according to debit card provider Eftpos which is claiming 400% growth of its mobile payments business.

While the data shows a substantial increase in digital adoption, the financial institutions will need to continuously review the needs of retail customer segments  and make it easy for their customers to adopt the digital technologies. Banks can look at the digital adoption across segments and device means to increase the adoption rate. The Essential Banking needs such as viewing accounts and transactions, making payments, availing loan and credits, remain similar for different segments despite the pandemic. The pandemic has primarily impacted the amount of traffic to branches, and cash withdrawals from ATMs. It has also resulted in a surge in demand to use digital channels to do essential banking, seek virtual support if there are issues and also have online tutorials to help users understand how to use online banking tools. Additionally, the pandemic has impacted the financial well-being of the retail customer segment, driving demand for hardship assistance, additional credit, and everyday money management tools online. The following highlights the digital banking needs of the retail customer segment, which the banks must address.

and make it easy for their customers to adopt the digital technologies. Banks can look at the digital adoption across segments and device means to increase the adoption rate. The Essential Banking needs such as viewing accounts and transactions, making payments, availing loan and credits, remain similar for different segments despite the pandemic. The pandemic has primarily impacted the amount of traffic to branches, and cash withdrawals from ATMs. It has also resulted in a surge in demand to use digital channels to do essential banking, seek virtual support if there are issues and also have online tutorials to help users understand how to use online banking tools. Additionally, the pandemic has impacted the financial well-being of the retail customer segment, driving demand for hardship assistance, additional credit, and everyday money management tools online. The following highlights the digital banking needs of the retail customer segment, which the banks must address.

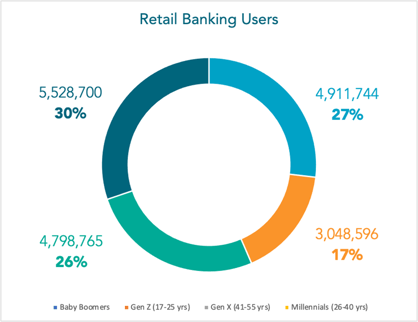

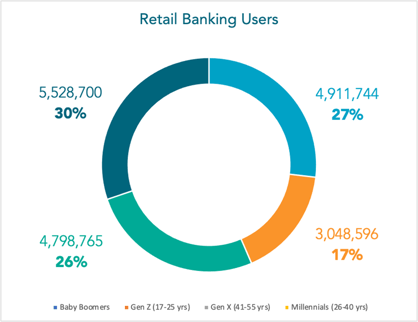

Baby Boomers

This segment comprises 27% of all customers, many of them retirees and less tech savvy than their younger counterparts. They have mostly conducted their banking through more traditional channels or may have received assistance from immediate family members to use digital banking. Their day to day financial needs focus around accessing their bank accounts, superfund accounts, bill payments, loan repayments and funding lifestyle expenses. While the loyalty towards financial institutions are high for this segment, they’ll be more concerned about the security aspects around digital banking technologies. The banks need to enable tutorials, provide virtual assistance (web chat or video chat) that is personalised if they want this customer to adopt digital banking, especially when looking at encouraging these customers to make payments that can reduce the frequency of their visits to branches or physical stores.

Gen X

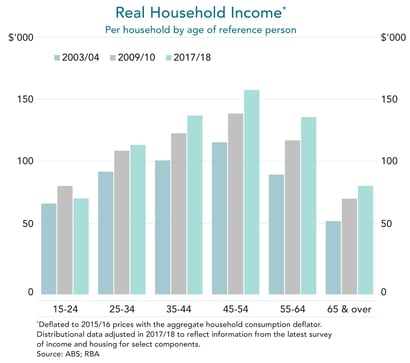

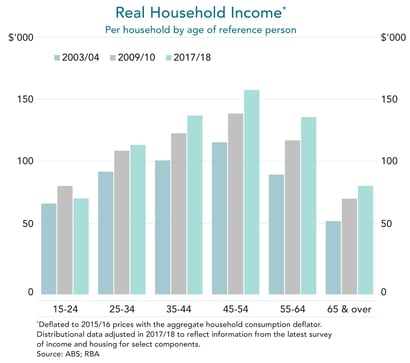

Comprising 26% of the population, this segment would be nearing or be at the peak of their income (refer to Real Household Income chart). Their banking needs are focused around viewing accounts, bill payments, funds transfer, loan and credit repayments, and active money management. These customers are driven by a need to build their savings as well as manage their expenses. This segment has good affinity towards digital technologies. While the pandemic has impacted all segments of society, the digital banking needs that can be targeted by banks and financial institutions for this segment include digital credit applications, money management, financial insights and usability. The availability of virtual assistance will definitely assist the less savvy digital users in this segment.

Millennials

Comprising 30% of the banking user segment, they are considered to be most tech savvy of all market segments. They are also in the life-stage where they may be looking for new loans or mortgages as well as looking to identify savings and investment opportunities. Ease of credit through online technologies, digital origination, knowledge base around financial assistance, personalisation of offers and contextual financial insights are of great value to retain this segment, as they continue their progression towards the peak income years.

Gen Z

Comprising 17% of the banking users, this segment is still setting their foot in the professional world. Some of them may be part of the gig economy or may be planning for higher education or may even be settling into a family life. They are highly digital savvy, avid users of social media and are highly open to try innovative features, hence in order to drive loyalty, the financial institutions need to focus on a personalised, self-service approach, making both the digital on-boarding frictionless and product information easily accessible. This segment along with the Millennials are the future income generator for banks. Hence, understanding the individual customer’s behaviour, preferences and anticipated future needs via sophisticated AI and ML tools is crucial. Banks can utilise these insights and create a personalised, semi-autonomous experience on the digital banking channel. Banks can further use interactive tools, such as calculators, customer feedback forms, chatbots to offer experiences, and deliver marketing messages to build stickiness and encourage retention with this segment.

"Viewing the retail banking landscape broken down into the needs of the various demographic segments, banks can easily identify the customer needs and identify the gaps in their online offerings."

With increased competition from digital only banks the pressure to satisfy customer needs is one faced by most financial institutions. However, the more traditional banks that have an existing customer base where the Baby Boomers and Gen X make up a large percentage of their customers can leverage these market segments brand loyalty to their own advantage. Enabling digital adoption for these segments centered on needs can help eliminate risks of customer attrition.

Additionally, it can provide opportunities to the bank in bringing further operational efficiencies particularly when they are reviewing their branch and ATM network. Segment specific offerings for Gen Z and Millennials would provide the established banks and Credit Unions the ability to ward-off competitive threats from the challenger banks. Applying Machine Learning and AI, on the data available through Open Banking can provide valuable consumer insights that can further enable personalisation and improved digital offerings. It’s up to banks to assess their existing digital banking offerings and define the roadmap to further increase digital adoption across the retail customer segments.

and make it easy for their customers to adopt the digital technologies. Banks can look at the digital adop

and make it easy for their customers to adopt the digital technologies. Banks can look at the digital adop